Budgeting Breakdown from AutoCFO CEO

Time to Build a Budget!

To start building your budget, select the budget icon, then click the budget builder link on the menu. This will direct you to our sandbox, which is our budget creation platform.

When you open the budget builder for the first time or select the “new budget” button on the right hand menu, our software generates a “starter budget.” The starter budget takes your last 12 months of financial data and uses it to create a “guess” of how costs will be allocated over the next 12 months.

This “guess” is a launching pad to start building your budget. You know the costs of your business better than anyone, so now it’s time to get your hands dirty! Dig into the sandbox. Start with income, do those numbers look right? If not, click the drop down menu in the projection methods column and try a different growth rate. Still doesn’t look like the revenue you anticipate? Use the manual entry function. You should note that if you use manual entry to make those entries for all future months, the budget goes out for the rest of the calendar year +2 additional years.

Still doesn’t look like the revenue you anticipate? Use the manual entry function. You should note that if you use manual entry to make those entries for all future months, the budget goes out for the rest of the calendar year +2 additional years.

Percentage Method

Manual Method

Play Around with Projection Methods

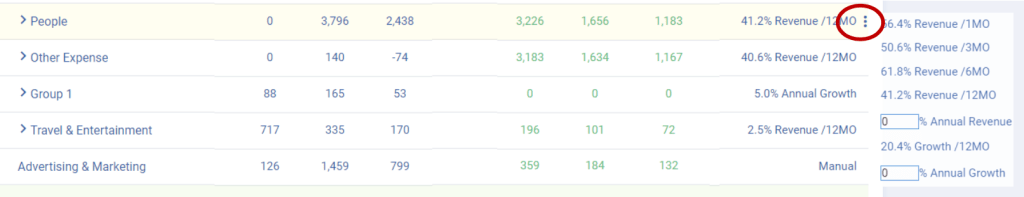

Next move down to expenses, cost of goods sold and operating expenses. Try out the various projection methods and see if the resulting costs (dollar values in each month) look accurate. Try percent of revenue for items that vary with revenue.

Use percentage growth, which is growth over the same month in the prior year, when an expense is relatively flat regardless of revenue or growth at a steady pace, like 3% salary increases or 5% rent increases.

Once you have put together what you think is a reasonable set of revenue and expenses, look at the annual version of the budget. Does this look accurate?

Hint: Select this button to view your financials annually:

Now look at the bottom line (net income). Is this what you expected to see for profit? When you look at the annual view, how does your expected profit compare to the prior year’s profit? If it is significantly different, look at your revenue and expenses and how they changed.

I typically start at the summary view, then dig down (expand revenue and expenses) looking for the line items that are the most different. Think about why they are different, does your rationale hold up? For example, people expenses are way down in our accounting department because we automated a lot of processes and were able to shrink the team by two people, is a strong rationale. If you aren’t planning on any operational changes that would affect a cost category, but it went up or down significantly, you may want to rethink that line item!

Finalize Your Masterpiece

Finally, once you are happy with your budget, title your budget something memorable. You can do this by clicking on the budget name on the top left hand side in the budget builder. Once your budget has a title, select publish in the top right corner. Do you would like to set this budget as your default budget, meaning the budget that compares to actuals throughout the app? Then return to the budget builder and select the check mark under the correct budget in the right hand budget menu.

Feel free to create multiple scenarios. What happens if you add two sales people in March and that causes revenue to go up by $10,000 per month in June? Import (see above image) your original budget into the sandbox and model it out! Budgeting is about planning, and planning is about options. With AutoCFO’s budgeting tool you don’t have to start from scratch – use a published budget as a starting place!

Now you know how to create a budget in AutoCFO!

Ready to start customizing your auto-generated budget, and get AutoCFO working for you? Start your 30-Day Free Trial today!